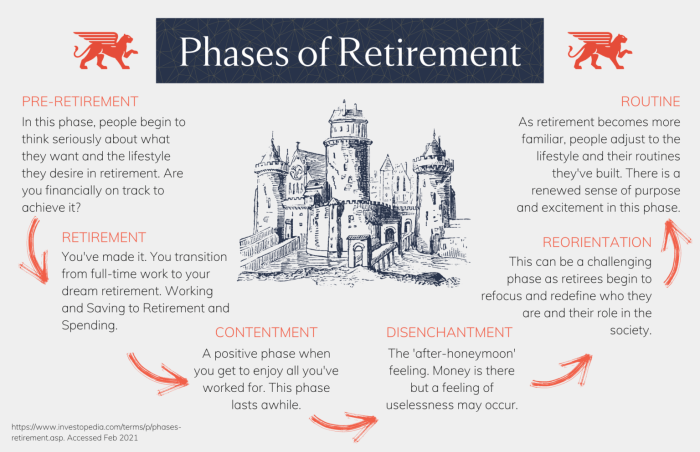

Robert atchley stages of retirement – Robert Atchley’s stages of retirement offer a comprehensive framework for understanding the multifaceted transitions individuals experience as they navigate the retirement journey. This guide delves into the key characteristics, financial implications, lifestyle adjustments, and emotional challenges associated with each stage, providing valuable insights and practical strategies for successful retirement planning.

Beginning with the pre-retirement stage, the guide explores the importance of financial planning, emotional preparation, and setting realistic expectations. It then examines the retirement stage, discussing financial management, lifestyle adjustments, and maintaining social connections and purpose. The post-retirement stage focuses on financial and healthcare considerations, downsizing, and estate planning, while the legacy stage explores the emotional and financial aspects of passing on values and experiences.

1. Pre-Retirement Stage

The pre-retirement stage is a period of transition that begins several years before an individual’s planned retirement date. During this stage, individuals focus on preparing financially and emotionally for the significant changes that retirement will bring.

Financial Planning Considerations, Robert atchley stages of retirement

- Maximize retirement savings contributions.

- Diversify investment portfolio to manage risk.

- Explore income-generating options for retirement.

Emotional Preparation

- Acknowledge and address feelings of anxiety or uncertainty.

- Identify hobbies and interests to pursue in retirement.

- Consider part-time work or volunteer opportunities to maintain a sense of purpose.

2. Retirement Stage: Robert Atchley Stages Of Retirement

The retirement stage begins when an individual officially retires from full-time employment. This stage is characterized by significant lifestyle adjustments and financial implications.

Financial Implications

- Transition from earned income to retirement income sources.

- Manage expenses and adjust spending habits to align with retirement budget.

- Consider potential healthcare expenses and long-term care costs.

Lifestyle Adjustments and Challenges

- Establish a new daily routine and find fulfilling activities.

- Cope with changes in social interactions and relationships.

- Maintain physical and mental health to enjoy retirement fully.

Maintaining Social Connections and Purpose

- Join social groups, clubs, or volunteer organizations.

- Engage in activities that provide a sense of purpose and meaning.

- Consider mentoring or teaching to share knowledge and skills.

3. Post-Retirement Stage

The post-retirement stage typically begins in the later years of retirement and is characterized by a focus on health, well-being, and legacy planning.

Financial and Healthcare Considerations

- Monitor financial resources and adjust expenses as needed.

- Explore long-term care options and insurance coverage.

- Seek regular medical check-ups and maintain healthy lifestyle habits.

Downsizing and Estate Planning

- Consider downsizing to a smaller home or assisted living facility.

- Prepare a will, estate plan, and power of attorney.

- Discuss end-of-life care preferences with loved ones.

Maintaining Independence and Well-being

- Engage in activities that promote cognitive and physical well-being.

- Maintain social connections and seek support from family and friends.

- Consider assisted living or home care services as needed to support independence.

4. Legacy Stage

The legacy stage is the final phase of retirement and is characterized by a focus on passing on values, experiences, and assets.

Emotional and Financial Aspects

- Reflect on life experiences and share wisdom with younger generations.

- Ensure financial security for loved ones through estate planning.

- Consider charitable donations or other ways to support causes that align with personal values.

Passing on Values and Experiences

- Share stories, family history, and life lessons with family and friends.

- Create tangible mementos, such as photo albums or written memoirs.

- Establish family traditions or rituals that can be passed down through generations.

Ensuring a Meaningful Legacy

- Consider establishing a scholarship or foundation in your name.

- Volunteer or donate time to organizations that align with your values.

- Live a life that reflects the values and principles you want to be remembered for.

Popular Questions

What are the key financial considerations during the pre-retirement stage?

Establishing a retirement budget, maximizing savings, and exploring investment options are crucial financial considerations during the pre-retirement stage.

How can individuals maintain social connections and purpose during retirement?

Volunteering, joining social groups, pursuing hobbies, and maintaining relationships with friends and family can help individuals maintain social connections and a sense of purpose in retirement.

What is the importance of downsizing in the post-retirement stage?

Downsizing can reduce financial burdens, simplify maintenance, and enhance accessibility, making it an important consideration for individuals in the post-retirement stage.